Differences Between Microchannel and Traditional Evaporators

In the world of heating, ventilation, and air conditioning (HVAC) systems, the choice of evaporators can significantly impact efficiency and performance. Microchannel coil represent a modern advancement over traditional evaporators, offering distinct advantages and addressing several limitations of conventional designs. This article examines the key differences between microchannel and traditional evaporators, highlighting the benefits and applications of each.

Design and Construction

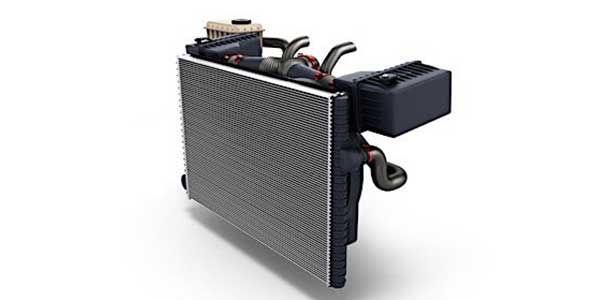

Microchannel Evaporators: Microchannel evaporators are constructed with flat tubes containing multiple small channels, or microchannels. These flat tubes are typically made from aluminum, which is known for its excellent thermal conductivity and corrosion resistance. The design maximizes the surface area for heat exchange within a compact space, enhancing overall efficiency.

Traditional Evaporators: Traditional evaporators usually consist of round copper tubes and aluminum fins. The refrigerant flows through the copper tubes, while the aluminum fins increase the surface area for heat transfer. This design has been widely used for many years but has certain limitations in terms of efficiency and size.

Heat Transfer Efficiency

Microchannel Coils: The increased surface area provided by the multiple microchannels in microchannel coils allows for superior heat transfer efficiency. The flat tube design minimizes thermal resistance, ensuring that heat is effectively absorbed from the surrounding …

Continue reading